Pet insurance: claim management processing

Abto Software has delivered custom applications that facilitate pet insurance and health coverage monitoring in the United States where conscious pet ownership is rapidly gaining momentum.

The project we covered was aimed at making pet insurance more straightforward for owners and businesses. The features include coverage for illnesses, wellness care, and accidents, as well as some optional add-ons – dental coverage, and other alternative therapies.

The implemented claim management processing functionality is another important feature worth mentioning. The designed claim system enables owners to file and businesses to process and reimburse eligible litigations.

Market overview

As stated by Global Market Insights, the pet insurance market was valued at impressive $8,6 billion in 2022. Growing adoption after the COVID-19 pandemic, which had emotional impact during lockdown and isolation, increasing awareness, greater availability of policies and services (dog insurance, cat insurance), as well as the and the rising costs of treatment are among the main influential factors.

- The pet insurance total premium volume in the United States was nearly $2,6 billion in 2022

- In 2021, there were 3,9 billion pets insured

- The average accident premium for dogs was $583 a year (2021)

- The average accident premium for cats was $343 a year (2021)

Claim management processing software: our vision

Abto Software is focusing on providing pet owners with accessible pet insurance and positive user experience. Our specialists’ main mission is helping pet owners to protect their companions by accessing flexible coverage and easy-to-navigate pet insurance claims processing automation tools.

Facilitating easy-to-navigate claim management

During the scope of the project, we delivered:

- Complete end-to-end software development

- UI/UX design

- Back-end development

- Database management

- Third-party integration

- The customization of the management system to meet the specific business needs

- The implementation of a security system to protect sensitive data

- Quality assurance

Our approach

Our teams can provide full-cycle services:

- UI/UX design

- The integration with external payment systems to enable smooth transactions

- Customer support system development, including chats and inquiry ticketing systems

- The integration with veterinary clinic databases to automate information retrieval

- Policy management system development to simplify data processing

- Claim management solution development to enable claim handling

- Extensive testing

- Ongoing support and maintenance after launch, including troubleshooting and enhancements

We see additional value in implementing:

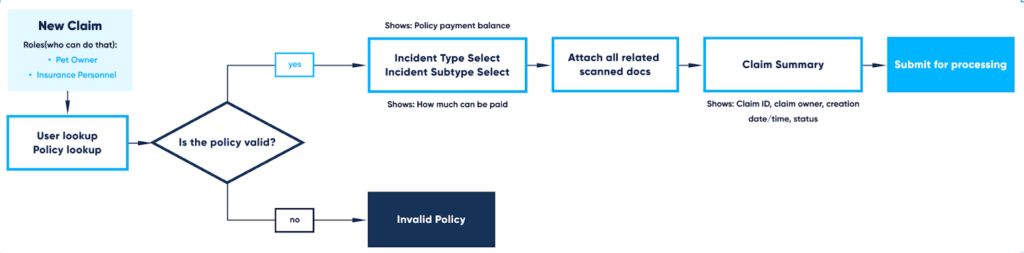

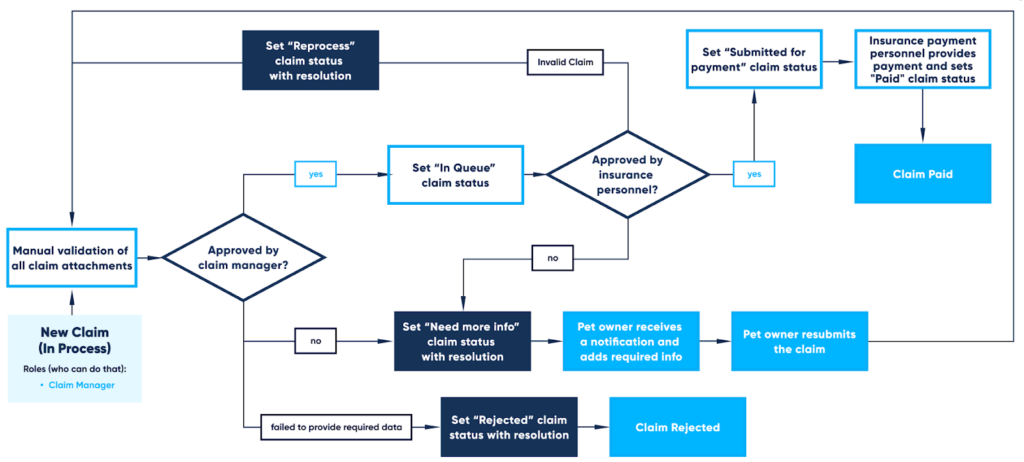

Claim management processing solution: quick dive-in

Most people experience difficulties with independent claim filing and management, as such bureaucratic affairs come with multiple nuances – document review, payment handling, and further claim submission and tracking. Our solution is designed to streamline these processes to benefit both end-users and businesses that provide pet insurance to reimburse veterinary care.

The concept is simple:

- The owner first visits the website of the insurance company to study the available insurance options – the levels of coverage, eligibility requirements, and pricing

- The owner then uses the platform to manage the policy, which includes

- Policy document review

- Payment information management

- Claim tracking

- In case of illnesses or accidents, the owner contacts the veterinary office

- After receiving necessary treatment, the owner can submit the claim to the insurance company through the easy-to-navigate platform

The employees on the vendor’s side review the claim submitted and determine its eligibility for reimbursement – if it gets approved, the customer receives reimbursement for the spent funds.

Throughout the policy term, the customers can use the platform to manage their policy.

Claim management processing software’ implementation benefits

By implementing on-demand functionality:

- User authentication and authorization

- User management

- Admin and doctor dashboards

- Customizable templates

- Appointment scheduling

- Automatic recommendations

- Enhanced analytics and reporting

- Automatic billing and invoicing

- Automation of claims processing

- Customer support

- Data security (encryption, authentication, access controls, regular backups)

- Third-party integrations (software and hardware integration)

- Cross-platform compatibility

- Cloud-based storage

- Mobile camera support

- Mobile PDF generation

We can bring value:

- To pet owners:

- Faster processing – the platform can help submit claims more quickly, reducing time and effort to complete the process, which helps to reduce unjustified expenses

- Greater accuracy – the solution can help eliminate errors and ensure that claims are accurate, reducing chances of delays or denials

- More transparency – by using the software, pet owners can track the process in real-time

- More convenience – by using the tool, pet owners can create and file a claim from anywhere and anytime

- To insurance companies:

- Easy processing – integrating automated claims processing, insurance providers can process claims efficiently, reducing resource-intense manual tasks

- Increased accuracy – claims processing automation adoption can help minimize errors, reducing potential reputational and financial damage

- Better service – by using the software, insurance companies can improve customer experience and outcomes

- Reduced fraud – the tool can help to detect fraudulent claims

How we can help

Abto Software sees promising future opportunities in implementing claim management processing solutions for strategic-thinking insurance companies that focus on efficiency and productivity.

Pet ownership in the United States and across the world has been increasing significantly over the last decades. Pet insurance is a growing industry, which saves pet owners considerable costs on emergencies and basic routine care.

Our expertise:

- .NET development

- ASP.NET development

- Web app development

- Mobile app development

- Cloud services

- Full-cycle development

To provide additional value, we implement:

Adopting technology to revolutionize the modern pet insurance industry using specialized expertise.

FAQ

To answer this question, what is pet insurance claims management?

To make this brief, pat insurance claims management is the inevitable process of handling claims submitted. That involves the verification and evaluation of submissions, as well as the further reimbursement for eligible veterinary expenses.

Custom-designed solutions can handle claims intake, data capture and validation, document management, adjudication, decision-making, and even payment processing.

How does pet insurance work, to begin with?

The process is straightforward, however, requires significant resources:

- After receiving veterinary treatment, the owner can submit a claim to the service provider

- The claim is examined to determine its eligibility for reimbursement, which involves data capture, adjudication, review, documentation, approval, and reimbursement

The benefit of implementing custom solutions is that these processes can be mostly automated, thus saving valuable resources – time, cost, and foremost human resources.

To identify the level of automation you need, ask yourself:

- What are the specific business goals and objectives for automation?

- What are the inefficiencies in the current workflows?

- What level of complexity do the claims involve?

- What are the typical claim volumes and frequency?

Another thing, what does pet insurance cover that might be also automated?

A customer is typically always pondering: “So, is pet insurance worth it to get from this particular company?”. And ensuring faster processing, greater accuracy, more transparency and convenience, you can make sure you’re winning the competition.